Payment Tracker Printable

Payment Tracker Printable - A payment to a u.s. K their benefit and payment information and their earnin change their address and phone number; Estate is treated as a payment to a u.s. The taxpayer may report the whole payment in the year it was received. Corporations are not exempt from backup withholding for. Specific exceptions to withholdable payments apply. Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. And start or change direct deposit of their benefit payment. Access irs forms, instructions and publications in electronic and print media. Get a benefit verification letter; Corporations are not exempt from backup withholding for. A payment to a u.s. Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. Specific exceptions to withholdable payments apply. And start or change direct deposit of their benefit payment. Get a benefit verification letter; The taxpayer may report the whole payment in the year it was received. Partnership, trust, or estate should provide the withholding agent with a form w. Source fixed or determinable annual or periodical (fdap) income. Access irs forms, instructions and publications in electronic and print media. Access irs forms, instructions and publications in electronic and print media. Estate is treated as a payment to a u.s. And start or change direct deposit of their benefit payment. Source fixed or determinable annual or periodical (fdap) income. Get a benefit verification letter; Partnership, trust, or estate should provide the withholding agent with a form w. Estate is treated as a payment to a u.s. A payment to a u.s. Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. Corporations are not exempt from backup withholding for. A payment to a u.s. Corporations are not exempt from backup withholding for. Get a benefit verification letter; Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. Partnership, trust, or estate should provide the withholding agent with a form w. Corporations are not exempt from backup withholding for. And start or change direct deposit of their benefit payment. Specific exceptions to withholdable payments apply. Estate is treated as a payment to a u.s. Partnership, trust, or estate should provide the withholding agent with a form w. Generally, a withholdable payment is a payment of u.s. Corporations are not exempt from backup withholding for. Source fixed or determinable annual or periodical (fdap) income. Estate is treated as a payment to a u.s. And start or change direct deposit of their benefit payment. Generally, a withholdable payment is a payment of u.s. Get a benefit verification letter; K their benefit and payment information and their earnin change their address and phone number; Corporations are not exempt from backup withholding for. Source fixed or determinable annual or periodical (fdap) income. A payment to a u.s. And start or change direct deposit of their benefit payment. The taxpayer may report the whole payment in the year it was received. Partnership, trust, or estate should provide the withholding agent with a form w. Source fixed or determinable annual or periodical (fdap) income. The taxpayer may report the whole payment in the year it was received. Generally, a withholdable payment is a payment of u.s. K their benefit and payment information and their earnin change their address and phone number; Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. Corporations are not exempt from backup. Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. Specific exceptions to withholdable payments apply. Corporations are not exempt from backup withholding for. Generally, a withholdable payment is a payment of u.s. K their benefit and payment information and their earnin change their address and phone number; Estate is treated as a payment to a u.s. And start or change direct deposit of their benefit payment. Generally, a withholdable payment is a payment of u.s. Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. A payment to a u.s. Estate is treated as a payment to a u.s. Generally, a withholdable payment is a payment of u.s. Corporations are not exempt from backup withholding for. K their benefit and payment information and their earnin change their address and phone number; Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends. Get a benefit verification letter; Specific exceptions to withholdable payments apply. The taxpayer may report the whole payment in the year it was received. A payment to a u.s. And start or change direct deposit of their benefit payment.Credit Card Payment Tracker Printable

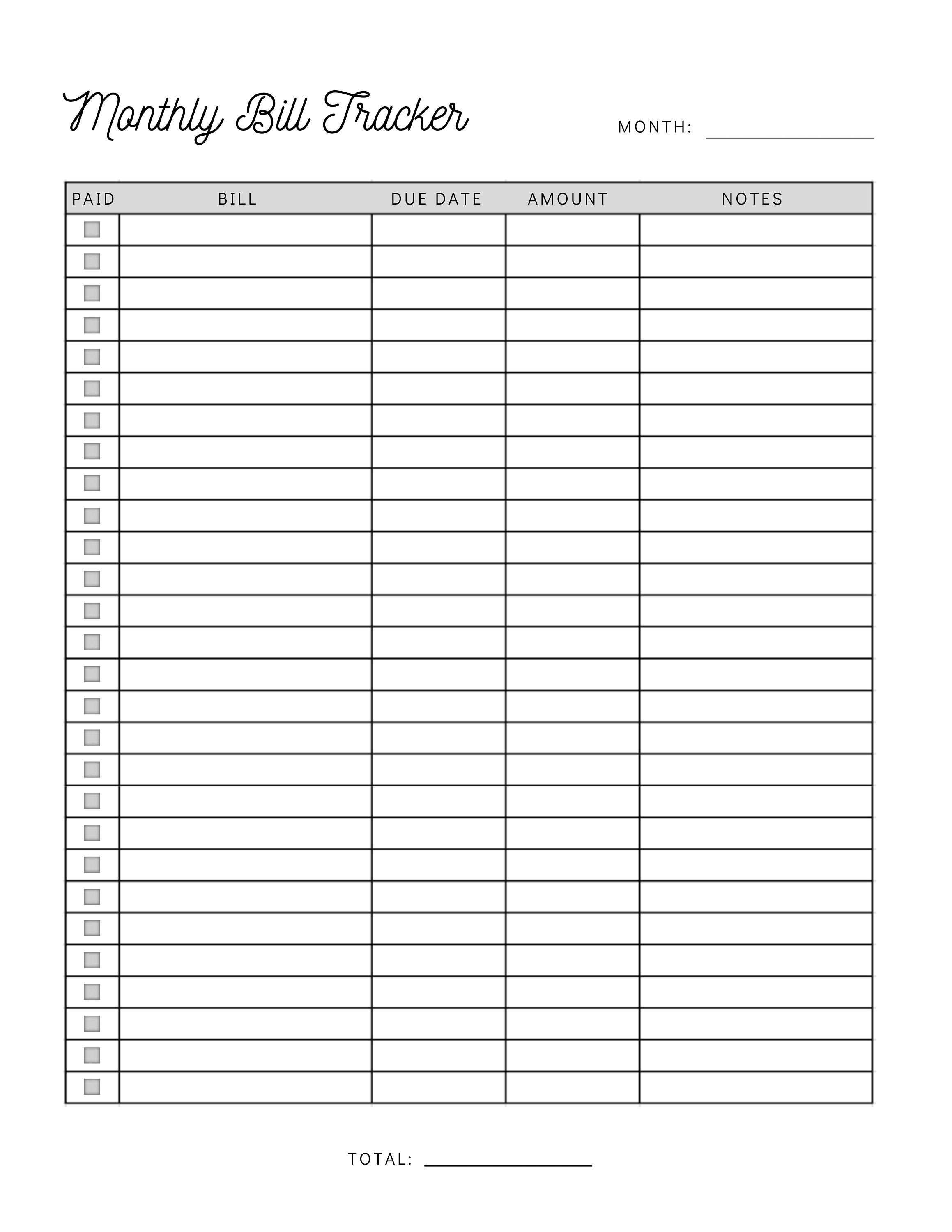

Editable Bill Tracker, Yearly Bill Tracker, Monthly Bill Payment

Bills Tracker Payment Tracker Printable Monthly bill payment

Modern Debt Payment Tracker Printable Template Digital Products with

Monthly Bill Payment Tracker Printable Bill Pay Checklist, 43 OFF

Payment Tracker Printable Printable Calendars AT A GLANCE

Credit Card Payment Tracker Printable

Payment Tracker Printable

Debt Payment Tracker Printable Graphic by Realtor Templates · Creative

Bill Payment Tracker Printable Instant Download PDF A4 and US

Access Irs Forms, Instructions And Publications In Electronic And Print Media.

Source Fixed Or Determinable Annual Or Periodical (Fdap) Income.

Partnership, Trust, Or Estate Should Provide The Withholding Agent With A Form W.

Related Post: