1040Ez Printable

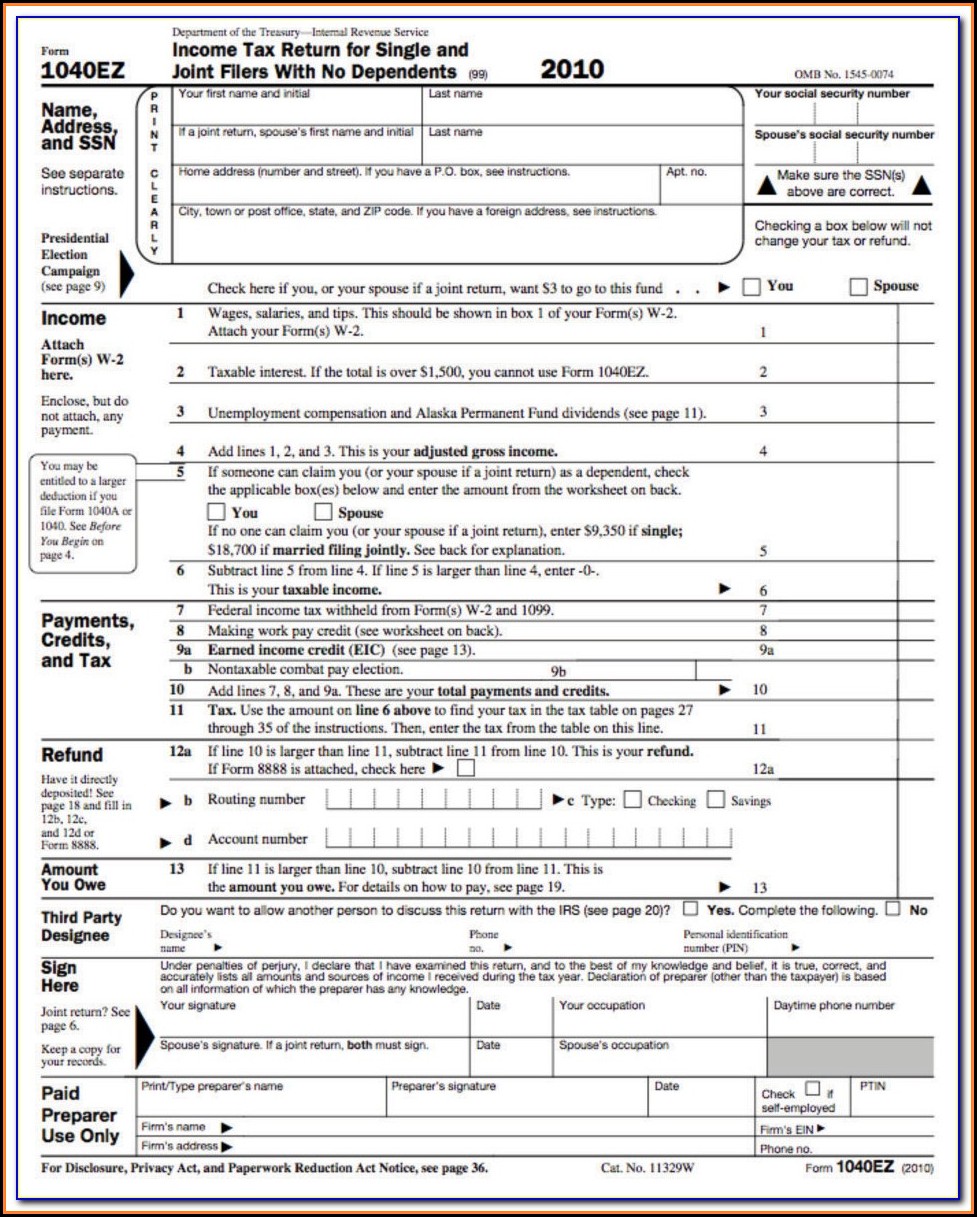

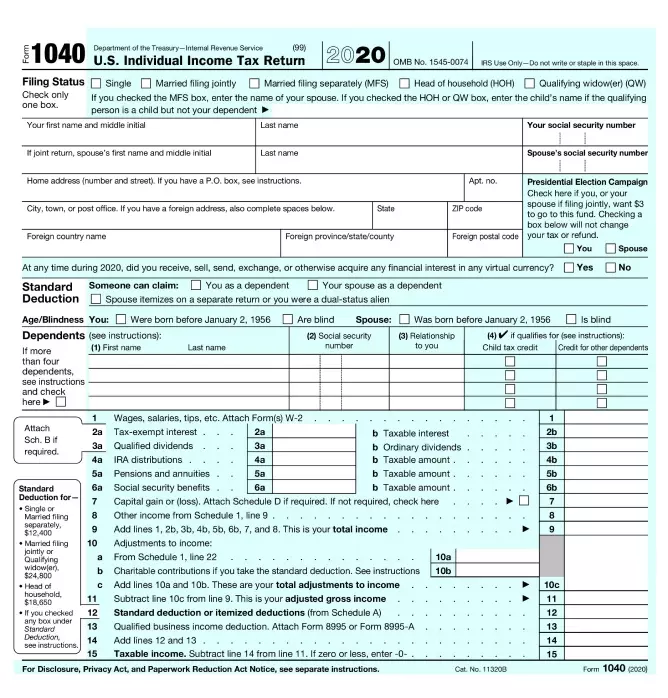

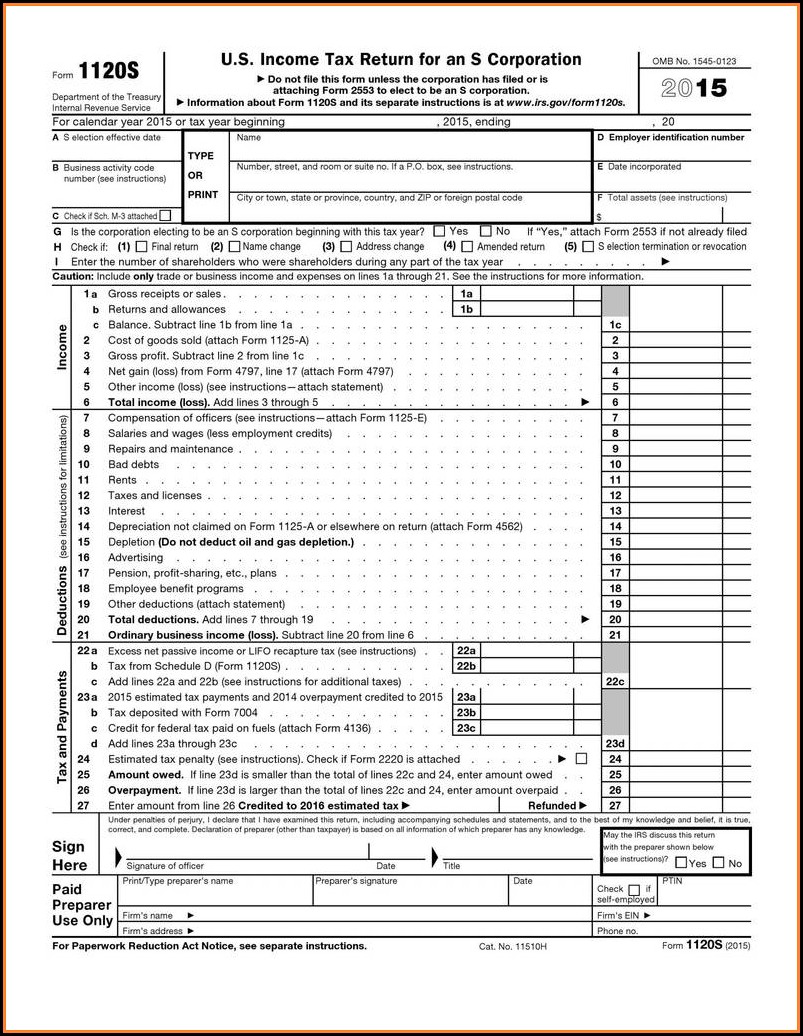

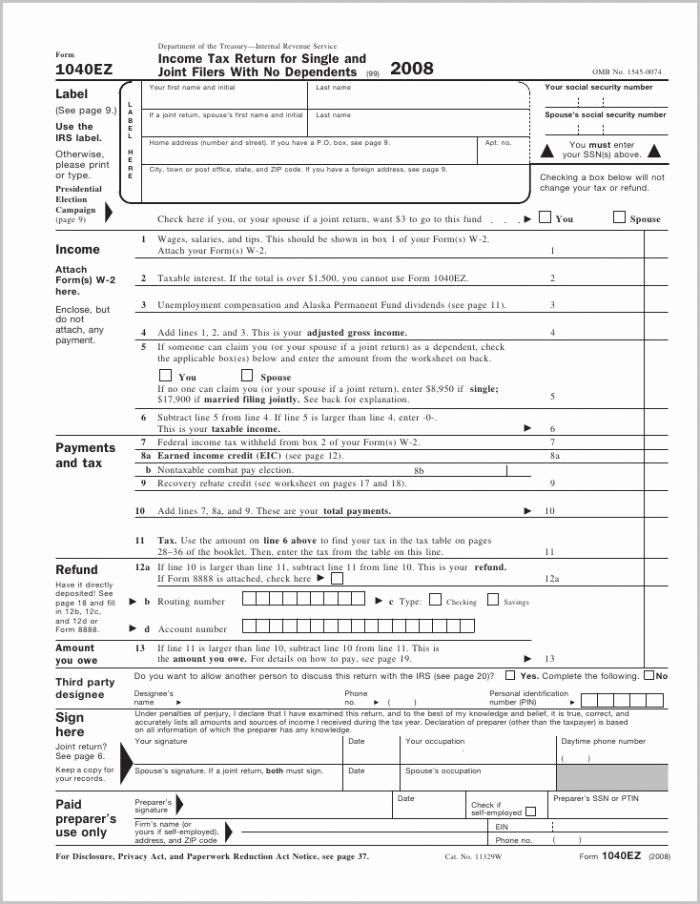

1040Ez Printable - And finally, the irs form 1040 should be used when itemizing. The 1040a covers several additional items not addressed by the ez. Form 1040ez was perfect for those under 65 with no dependents and an income below $100,000 per year. The simplest irs form is the form 1040ez. The 1040ez form was introduced in 1982 by the internal revenue. It facilitated easy tax filing for single or. The 1040ez form was a simplified irs tax return for single and joint filers with no dependents, but it was replaced by a revised form 1040 in tax year 2018. Form 1040ez was a simplified individual income tax form provided by the irs, tailored for taxpayers with straightforward financial situations. It allowed single and joint filers with no dependents with basic tax reporting needs to file their taxes in a. Irs form 1040ez was a shortened version of the irs tax form 1040. Employer's quarterly federal tax return. It allowed single and joint filers with no dependents with basic tax reporting needs to file their taxes in a. The 1040ez form was introduced in 1982 by the internal revenue. Form 1040ez was used for taxpayers with a simple tax return, filing status of single. The simplest irs form is the form 1040ez. The 1040ez form was a simplified irs tax return for single and joint filers with no dependents, but it was replaced by a revised form 1040 in tax year 2018. It was much shorter than the standard form 1040, with fewer. Irs form 1040ez was a shortened version of the irs tax form 1040. Irs form 1040ez is a discontinued income tax return for single and joint filers with no dependents. The 1040a covers several additional items not addressed by the ez. Form 1040ez was used for taxpayers with a simple tax return, filing status of single. It facilitated easy tax filing for single or. For taxpayers with simple tax. The simplest irs form is the form 1040ez. It allowed single and joint filers with no dependents with basic tax reporting needs to file their taxes in a. The 1040ez form was a simplified irs tax return for single and joint filers with no dependents, but it was replaced by a revised form 1040 in tax year 2018. Employer's quarterly federal tax return. Irs form 1040ez was a shortened version of the irs tax form 1040. Irs form 1040ez is a discontinued income tax return for single and. Irs form 1040ez was a shortened version of the irs tax form 1040. For taxpayers with simple tax. The simplest irs form is the form 1040ez. Form 1040ez was used for taxpayers with a simple tax return, filing status of single. It was much shorter than the standard form 1040, with fewer. The 1040ez form was introduced in 1982 by the internal revenue. Irs form 1040ez was a shortened version of the irs tax form 1040. The 1040ez form was a simplified irs tax return for single and joint filers with no dependents, but it was replaced by a revised form 1040 in tax year 2018. Form 1040ez was perfect for those. Employer's quarterly federal tax return. Irs form 1040ez was a shortened version of the irs tax form 1040. The 1040ez form was introduced in 1982 by the internal revenue. For taxpayers with simple tax. It facilitated easy tax filing for single or. Irs form 1040ez is a discontinued income tax return for single and joint filers with no dependents. The 1040a covers several additional items not addressed by the ez. Form 1040ez was perfect for those under 65 with no dependents and an income below $100,000 per year. It was much shorter than the standard form 1040, with fewer. Irs form 1040ez. Form 1040ez was perfect for those under 65 with no dependents and an income below $100,000 per year. The 1040ez form was a simplified irs tax return for single and joint filers with no dependents, but it was replaced by a revised form 1040 in tax year 2018. Irs form 1040ez was a shortened version of the irs tax form. It allowed single and joint filers with no dependents with basic tax reporting needs to file their taxes in a. The 1040a covers several additional items not addressed by the ez. Employer's quarterly federal tax return. The 1040ez form was introduced in 1982 by the internal revenue. And finally, the irs form 1040 should be used when itemizing. The 1040a covers several additional items not addressed by the ez. Form 1040ez was perfect for those under 65 with no dependents and an income below $100,000 per year. Form 1040ez was a simplified individual income tax form provided by the irs, tailored for taxpayers with straightforward financial situations. Irs form 1040ez is a discontinued income tax return for single. It facilitated easy tax filing for single or. It allowed single and joint filers with no dependents with basic tax reporting needs to file their taxes in a. Employer's quarterly federal tax return. Form 1040ez was used for taxpayers with a simple tax return, filing status of single. The 1040a covers several additional items not addressed by the ez. The simplest irs form is the form 1040ez. And finally, the irs form 1040 should be used when itemizing. It facilitated easy tax filing for single or. Form 1040ez was a simplified individual income tax form provided by the irs, tailored for taxpayers with straightforward financial situations. Irs form 1040ez is a discontinued income tax return for single and joint filers with no dependents. Employer's quarterly federal tax return. Irs form 1040ez was a shortened version of the irs tax form 1040. It was much shorter than the standard form 1040, with fewer. Form 1040ez was perfect for those under 65 with no dependents and an income below $100,000 per year. The 1040ez form was introduced in 1982 by the internal revenue. Form 1040ez was used for taxpayers with a simple tax return, filing status of single. For taxpayers with simple tax.Free Printable Tax Id Forms Printable Forms Free Online

Printable Form 1040Ez

1040Ez Printable Form

Irs 1040Ez Printable Form

Tax 1040ez Online Instructions

1040ez Form Printable

Printable 1040ez Form 2025 Lori M. Williams

Printable Federal 1040ez Form Printable Forms Free Online

Printable Form 1040ez Printable Forms Free Online

Printable Forms Irs Printable Forms Free Online

It Allowed Single And Joint Filers With No Dependents With Basic Tax Reporting Needs To File Their Taxes In A.

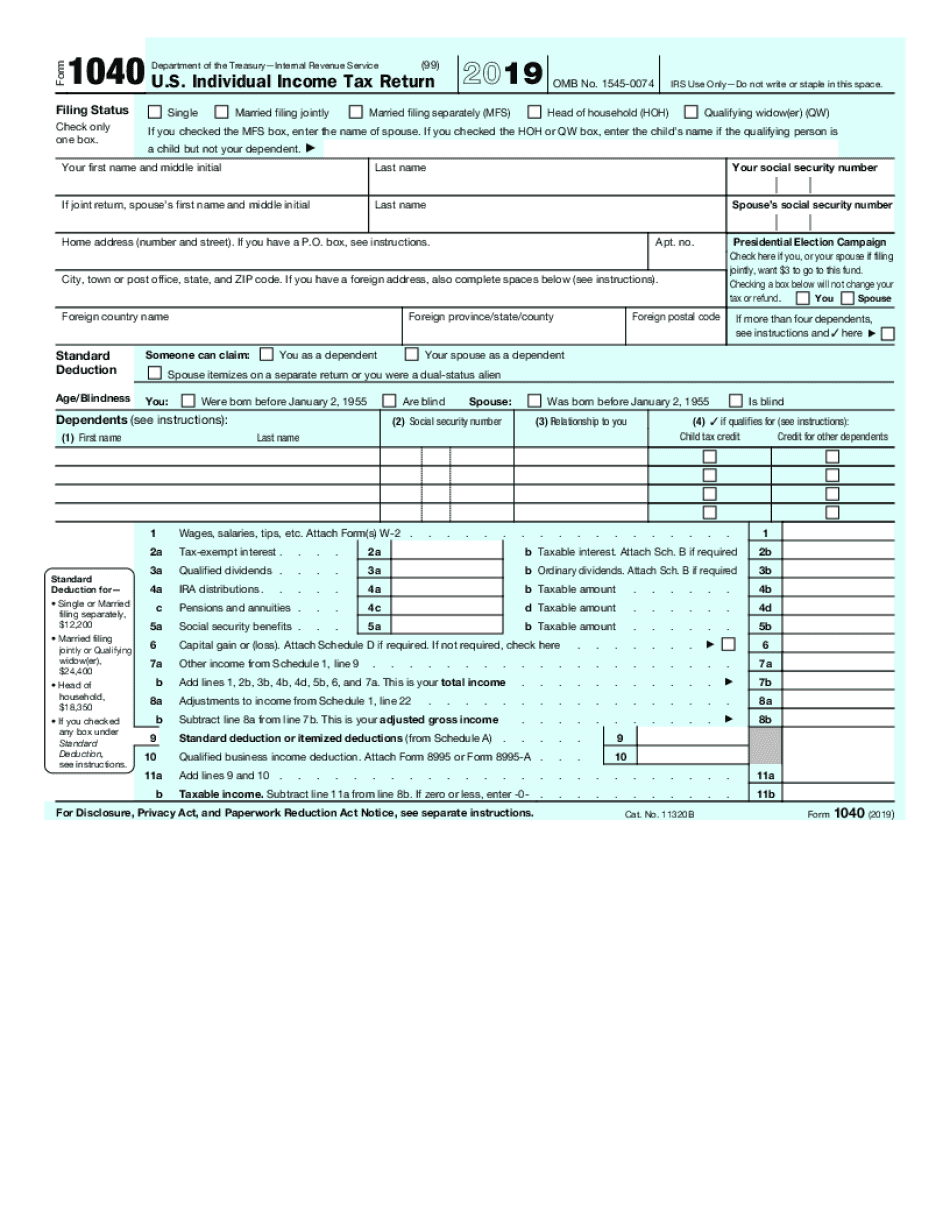

The 1040Ez Form Was A Simplified Irs Tax Return For Single And Joint Filers With No Dependents, But It Was Replaced By A Revised Form 1040 In Tax Year 2018.

The 1040A Covers Several Additional Items Not Addressed By The Ez.

Related Post: